BBC

BBCThe cash machine distraction and other scams - how not to get fleeced

No-one likes to think they’ll be the one to get hustled or fall for a scam. But scams are getting ever more sophisticated.

These days, you don’t even have to leave your bedroom to get fleeced. They come in all guises - emails, texts, phone calls, etc. But as the industry invests huge amounts of money to stop criminals, fraudsters are increasingly targeting people directly. These are some of their favourite scams:

- Phishing: a method used by fraudsters to access valuable personal details, such as usernames and passwords, by e-mail.

- Vishing: fraudsters obtain personal information from a victim by phone

- Smishing: fraudsters obtain personal information from a victim by text message

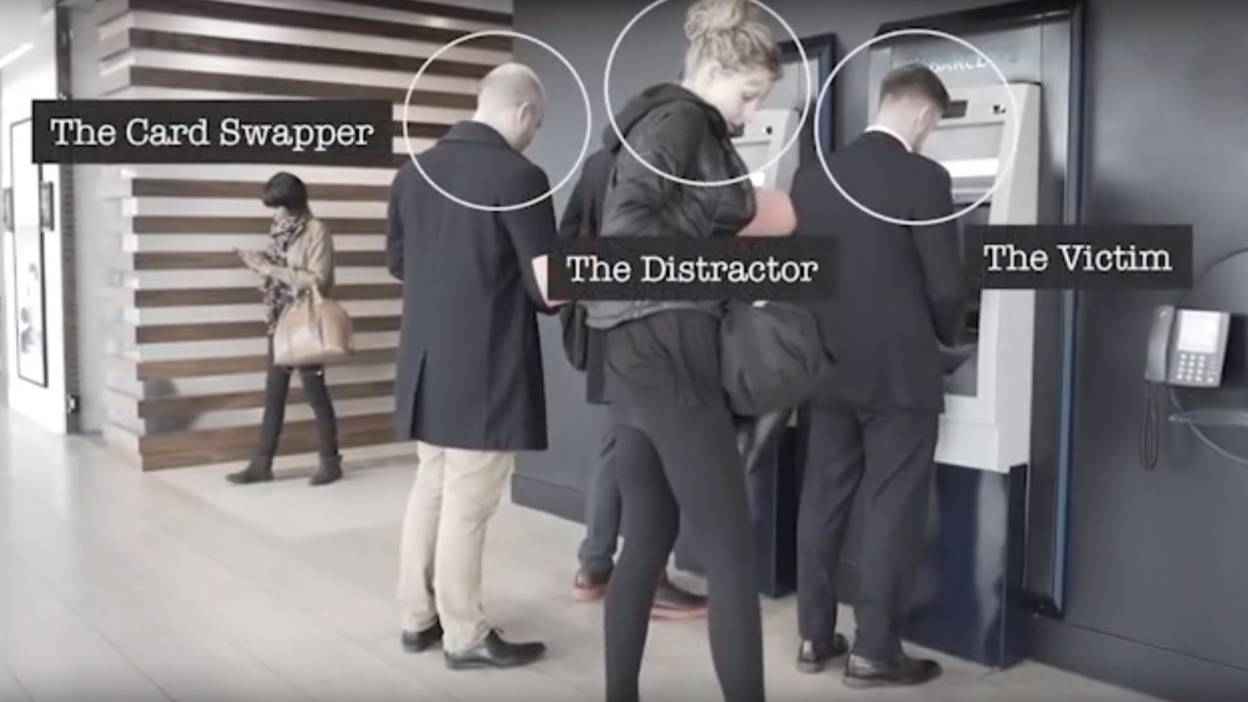

But check out this hustle: ‘The Distraction Scam’. It doesn’t involve phishing, vishing or smishing. But it’s bold, it’s ballsy and it could leave you seriously out of pocket. In these pics, actors show how it works.

BBC

BBC

The ‘victim’ is at the ATM on the right. The ‘distractor’ is standing behind him. The ‘card swapper’ is standing next to the victim, at the ATM on the left.

BBC

BBC

He’s ready with his fake cards.

BBC

BBC

The distractor clocks the victim’s PIN as he enters it at the machine...

BBC

BBC

Then, just at the right time, she causes a distraction by dropping her money. This causes the victim to be drawn away from the ATM to help our poor damsel in distress pick up her coins...

BBC

BBC

Meanwhile, the card swapper leans in, nicks the victim’s card from the machine and replaces it with a fake one.

BBC

BBC

When the victim returns to the ATM, he sees his cash and what looks like his card. He suspects nothing.

BBC

BBC

The distractor then passes the PIN on to the card swapper.

BBC

BBC

The card swapper uses the stolen card and PIN to gain full access to the victim’s bank account. Drains their account. Hits the shops. Easy...

The most common type of crime

In the last year, cash machine scams rose by a fifth to over £32 million, while recent figures suggest that fraud is the most common type of crime in the UK.

Last year, there were nearly six million fraud and cyber-crimes in the UK, at rate that costs us a whopping £193 billion a year.

It's become such a problem that last week, Barclays Bank launched two new TV adverts warning people about email and text scams.

A Barclays spokesperson told Watchdog: “Barclays is determined to do all it can to combat fraud. We've had a media campaign across all of our different channels, direct mails, in-branch posters and ATMs, so it actually just felt like a really natural step to put our weight behind a TV campaign.”

Katy Worobec, Director of Financial Fraud Action UK, tells Watchdog, "Banks work extremely hard to protect their customers, using highly sophisticated security systems which stopped 70 per cent of attempted fraud from occurring last year.

“With the continued rise in impersonation scams, it is vital that all customers are alert to the dangers. That’s why it’s vital that everyone is extremely cautious about giving out their personal or financial information.

“Your bank or the police will never call you to ask for your four-digit card PIN or your online banking password, or for you to transfer money to a new account for fraud reasons, even if they say it is in your name.”

How to avoid the Distraction Scam

To finish off, here are six simple steps you can take to beat this latest hustle

- Be rude! Ignore people who speak to you when you’re at an ATM

- Don’t let anyone distract you

- Cover your PIN when you pay in shops or go to a cash machine

- Don’t use an ATM if it, or anyone around it, looks suspicious

- Call your bank if you think your card, PIN or other security details have been compromised

- Be paranoid!

If you've fallen for a scam like the Cash Machine Distraction, or have another consumer problem you think Watchdog should investigate, send us your story or email Watchdog@bbc.co.uk.

This article was first published on Wednesday July 27th, 2016