Alright, so maybe you’re already pretty fabulous, and this whole ‘New Year, New You’ stuff bores you to tears. But either way, like most of us, you're probably planning on making at least a few changes in the year to come.

Whether you want to get fit, be healthier or get more organised, there are a few things you need to watch out for if you want to take care of your bank balance too...

Gym memberships

Getty Images

Getty Images

One in seven people in the UK is a member of a gym, and the industry is estimated to be worth around £4.4billion. The New Year is a busy time for fitness facilities, but before you sign up, make sure you read the terms and conditions of the contract. Most importantly, check you have the right to cancel. It’s not that we don’t have any faith in you, but, if the year doesn’t pan out the way you want it to and life gets in the way of you hitting that treadmill, you need to make sure you can cancel your membership so you’re not tied into a lengthy contract that is costly to cancel.

If your circumstances change - for example, if you get made redundant or suddenly find yourself in debt and you have difficulty cancelling your membership - then go to Citizens Advice or to the Consumer Ombudsman.

If you’re not sure you’ll stick to your gym routine try a pay-as-you-go option first. It might be more expensive in the short-term but if you keep at it, then you know joining a gym full-time will be worth your while. You could also consider using a no-frills gym which doesn’t have lengthy contracts or expensive cancellation fees. Alternatively, join a council-run gym: they're often cheaper than private gyms.

Diet and weight loss

Getty Images

Getty Images

According to research 63% of Brits plan to make New Year’s resolutions and the most common goal is to lose weight. If you fall into this category, then you need to watch out for the pop-ups that offer a ‘free trial’ for weight-loss products. Things on the internet are rarely free.

Once you’ve entered your details for postage and packaging, you may find you’ve accidentally signed yourself up to a hidden contract. You then find that regular sums of money are taken from your account. As ever – read the small print.

Check what the returns policy is, and what the charges are after the ‘free trial’ ends. See our previous report for more info.

Britain’s diet industry is worth £2billion and dietary supplements are big business. Many companies advertise on social media and claim to have an array of health benefits. But they don’t always stack up. For example, Watchdog investigated Juice Plus+, which sells supplements. It’s a franchise that uses brand advocates across the world, and Watchdog found that some of the advocates were making questionable claims about the supplement’s effectiveness, such as weight loss - and using fake photos.

Juice Plus+ says "Wherever it finds franchisees making misleading or false claims it steps in to stop it."

So, if you’re about to try something, do your own research and apply a sceptical approach.

Last year, one in six people attempted Dry January. This year there will probably be more. You’ll save money, perhaps lose weight, sleep better and have more energy. But if giving up the booze doesn’t float your boat, how’s about giving up animal products for a month instead? It’s part of a campaign called Veganuary and is in its third year. Whether you do it for the love of animals, health benefits or think it will help the planet, you could well save some money in the process.

Mobile phones

Getty Images

Getty Images

Are you constantly going over your data allowance and paying extra for bolt-ons? Or maybe it's the opposite: you always have loads of data left at the end of the month? Either way, give your mobile phone provider a buzz and check you’re on the right package. There could be savings to be made. Comparison websites will help you compare deals.

Voucher codes

After the festive splurge, eating out or buying online could be painful to your wallet – but fear not. Do a search online for money-off vouchers and get saving.

Cashback websites

If you use a cashback website when shopping online you could make hundreds of pounds a year. They'll pay you if you go through them to purchase stuff – anything from clothes to mobile phone contracts.

Check your direct debits

Getty Images

Getty Images

Are you still paying for something you don’t want or have cancelled? Did you switch from Sky to Virgin but forget to cancel your DD? Have you been caught out by Amazon Prime’s £79 fee while ordering all your Christmas presents in December?! Go through your DDs and double check what you’re paying for.

Contact your bank straight away if you’re owed any money. Under the direct debit guarantee any money that has been wrongly taken will immediately be refunded.

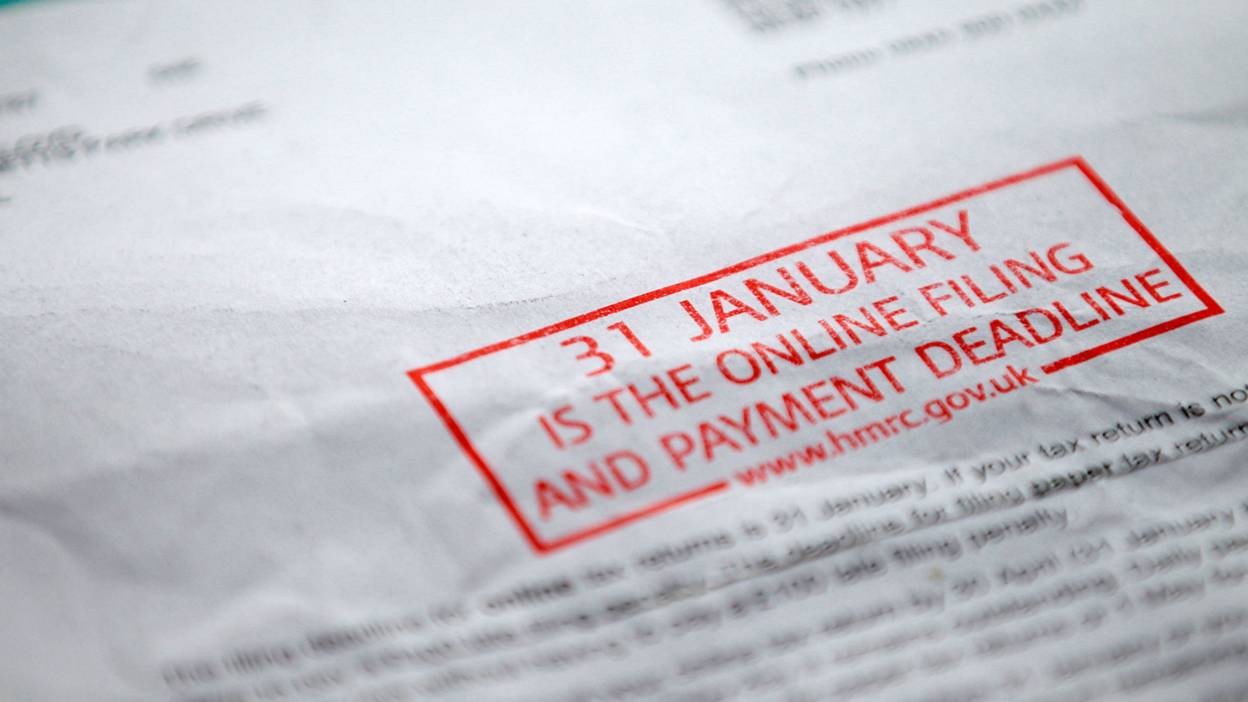

Self-employed? Get your tax return in – quick!

Last year, over 900,000 people were late submitting their tax returns. Many, but not all, will have been fined. Don’t you be one of them. The deadline is 31 January. If you miss it (within three months), it’s a £100 fine. If it’s later than three months, you pay even more.

Not all of us like to make New Year’s resolutions, so if you're only willing to make one, let it be that 2017 will be the year of switching. Whether it’s energy, insurance, bank or broadband supplier. Switch, switch, switch! You’ll save, save, save.

So buckle up and motor into 2017 like you mean it.

Car insurance

Getty Images

Getty Images

Whatever you do, don’t let your motor insurance renew automatically. It’s highly likely you won’t reap any rewards for showing loyalty to your insurance company. Shop around and switch insurer. You could save hundreds. There are lots of comparison websites out there to help. Also, don’t leave renewing to the last minute. You’ll get a better deal if you do it 30 days in advance of your old premium running out, and if you have the option to park off road – do so and tell your insurer.

Insurance premium tax is set to increase from 10% to 12% in June 2017. Most insurers will lock in a quote for 60-90 days so check when your policy is up for renewal - you might be able to do it before this price increase affects you.

A couple of other things - if you’re a young driver, think about adding another driver who is older than you and more ‘safe’, it could bring down the premiums. But, if you want to ‘pimp your ride’, it might cost you: alloy wheels, phat exhausts and bright lights will only pimp your premiums.

Bank

Ok, so maybe you switch energy provider regularly, but research carried out by ComRes on behalf of BBC Watchdog reveals that 70% of 18-34 year olds have never changed their current account bank provider.

If you’ve had shoddy service, pay high fees or get a low interest rate on your savings then do something about it. Switch. You might even get up to £150 cash for the trouble. All you need to do is decide which bank you want to switch to, pop in to see them, sign some paperwork, show your ID and, if the bank is part of the Current Account Switch Service, the rest is taken care of by the banks and should take about seven working days.

If you have a story you think we should investigate email watchdog@bbc.co.uk